Tipped Income

Proper entry of income into FAMIS is essential to good casework and payment accuracy.

When reviewing income verification, it is important to pay close attention to the details and have a conversation with the participant if there seems to be tipped income.

When a participant earns tips, create two (2) sources of income for that employer; one for wages (WA) and one for tips (TI).

The proper way to enter tipped income into FAMIS depends on the situation. Consider the following:

Does the wage verification include all tips (paid by cash and credit/debit card) OR does the participant or employer keep a separate ledger for any tips?

-

- If all tips (cash and credit/debit card) are shown on the income verification:

- Enter the total gross pay on the wages (WA) budget

- Then, enter the amount identified as tips in the Irregular Amount field so FAMIS will not count the tips as part of the participant’s regular wages

- Budget the tips separately as their own income source (TI)

- If any tips are kept on a separate ledger:

- Enter the tips (if any) identified on the income verification in the wage (WA) budget’s Irregular Amount field (as stated above)

- Add all tips (cash and credit/debit card) from income verification as well as all tips from the ledger together and budget that total as its own income source (TI)

- If all tips (cash and credit/debit card) are shown on the income verification:

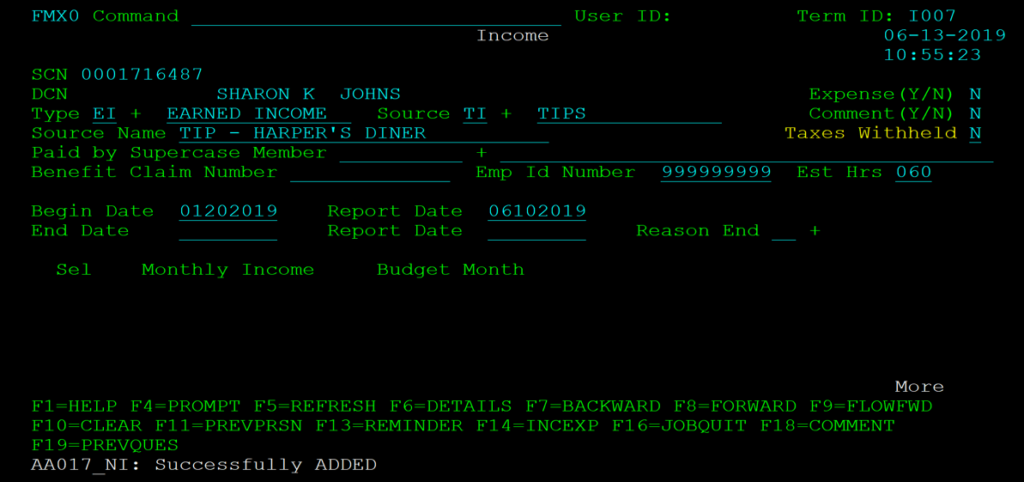

Example of entering tipped income:

Sharon applied on 6/10/19. She works as a server at Harper’s Diner. Sharon receives wages as well as tips. Her paystubs show the credit/debit card tips and Sharon keeps her own ledger of cash tips.

Entries on Income (FMX0) screen:

-

- From Income (FMX0), type an A in the Command line

- Enter Type (EI) & Source (WA)

- Enter Source Name

- Answer Y/N for Taxes Withheld

- Enter Emp Id Number (if known) & Est Hrs

- Enter Begin Date (date the employment began)

- Enter Report Date (date reported to FSD)

- Press CTRL

-

- Press F6=DETAILS to enter wage information

Entries on Income Amount (FMX3) screen:

-

- From Income Amount (FMX3), type an A on the Command line

- Enter Budget Month

- Enter Frequency Code

- Enter appropriate Calculation Method

- Enter Y/N in Hourly field and Pay/Hour

- Enter all known income information:

- Enter total gross of pay period in Gross Amount field

- Enter tips listed on the income verification in the Irregular Amount field

-

- Press CTRL

- Press F18=COMMENT and record the details as to why income was entered as an Irregular Amount and why it is correct.

A separate income source will need to be created for the tipped income

Entries on Income (FMX0) screen:

-

- From Income (FMX0), type an A in the Command line

- Enter Type (EI) & Source (TI)

- Enter Source Name

- Answer Y/N for Taxes Withheld

- Enter Emp Id Number (if known) & Est Hrs

- Enter Begin Date (date the employment began)

- Enter Report Date (date reported to FSD)

- Press CTRL

-

- Press F6=DETAILS to enter tipped income

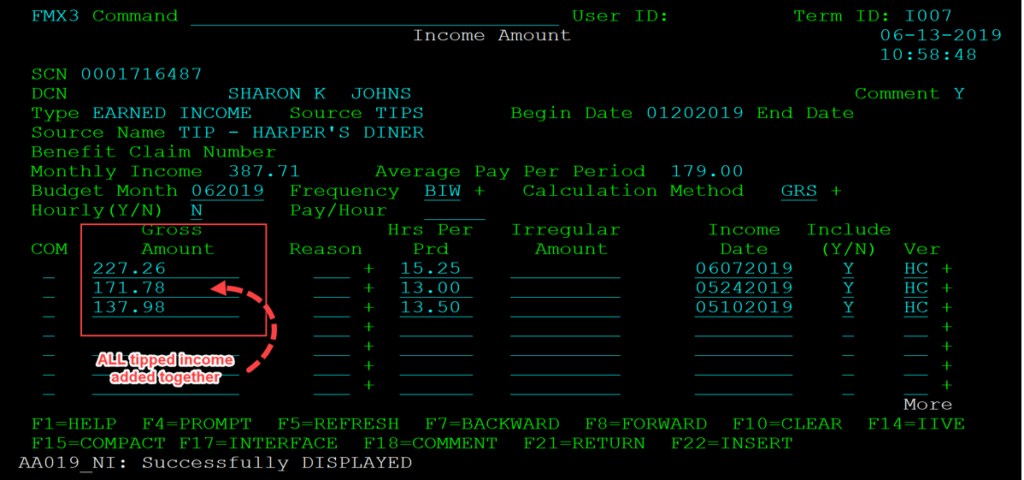

Entries on Income Amount (FMX3) screen:

-

- From Income Amount (FMX3), type an A on the Command line

- Enter Budget Month

- Enter Frequency Code

- Enter appropriate Calculation Method

- Enter N in Hourly field

- Enter all known income information:

- Add together all tipped income (credit/debit card & cash) and enter that amount in the Gross Amount field

-

- Press CTRL

- Press F18=COMMENT and record the details as to why income was entered as it is and why it is correct. Include any and all calculations performed outside of FAMIS.