New Spouse Disregard

A new spouse of a TA participant may have his/her resources and income disregarded for six consecutive months.

The income and resources of a TA recipient’s new spouse may be disregarded for six consecutive months. This once per lifetime disregard is allowed when a TA recipient marries, regardless of whether the new spouse was already an EU member.

When an existing TA participant gets married:

-

- Add the new spouse to the Supercase and EU, if not already a member

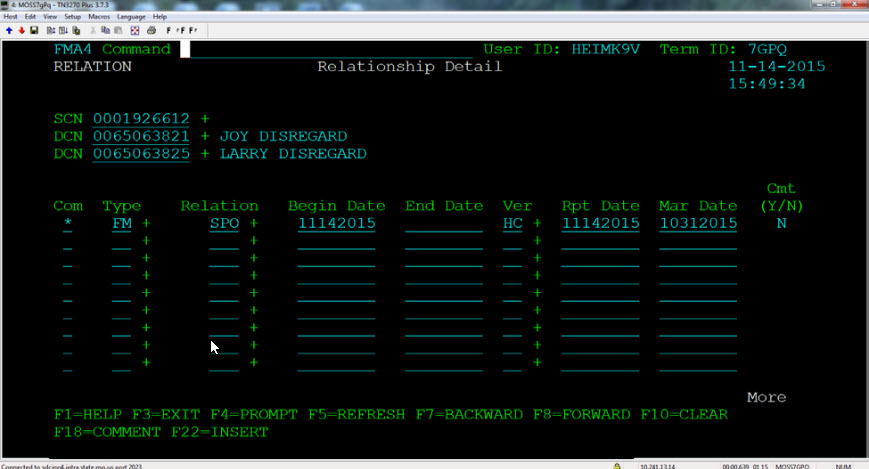

- Add/Update and verify the relationships on Relationship Detail (RELATION/FMA4)

-

- For single parent households: establish relationship

- For existing two parent households: Update the relationship status from NRP to SPO

-

-

- After the marriage date is entered on RELATION, this statement displays:

![]()

-

-

-

- If a date prior to August 28, 2015 is entered under the “Mar Date” field, this warning statement will display:

-

-

![]()

-

-

-

- Leave the Marriage Date field blank if the marriage was prior to August 28, 2015.

-

-

-

-

- Add/Update marital status SCMBR

- For single parent households ONLY, Go to FM0G/REQUEST and complete an add-a-person application,

- Add the disregard on Earned Income Disregards (DISREGRD/FMXT), for the spouse being added to the EU.

-

- If applying New Spouse Disregard to a two-parent TA EU, add the disregard to BOTH spouses.

-

-