SNAP Able Bodied Adults Without Dependents (ABAWD)

Effective July 1, 2023 ABAWD criteria has resumed for SNAP. The new 36-month clock runs from July 1, 2023- June 30, 2026.

Click on these links to jump down the page and learn how to handle specific situations:

| Initial Eligibility | Losing Eligibility | Regaining Eligibility | Expedite | After Regaining Eligibility | Tracking Work/Training Hours |

Requirement

SNAP recipients identified as ABAWDs (Able Bodied Adults Without Dependents) are subject to different work requirements than other participants. They are limited to 3 months of benefits in a set 36 month period if they are not:

-

- Working or volunteering for 80 hours or more per calendar month

and/or

-

- Participating in a qualified training program for 80 hours or more per calendar month

The current 36 month period runs from July 1 2023- June 30 2026.

Training/Work Requirements (WORKREQ/FMMR) appears in the FAMIS interview controlled flow. Entries for people who are ABAWDs are required in the Work Requirement Code and Begin Date fields at application, mid-certification review and when changes are reported:

-

- 01 – Zero (0) Hours Worked\No Employment

- 02 – 80 Hrs Not Met Yet

- 03 – Work/Trng to Equal/Exceed 80 Hours

- 50 – No Longer Identified as an ABAWD

If the Work Requirement code is 01 or 02, entries in the Non-Work Months field(s) are required. Staff must enter the correct non-work month(s), so FAMIS can take the correct action, at the right time, to exclude an ABAWD who has used the three non-work months:

-

- Adjusting the SNAP issuance for eligible household members

- Closing the case if the ABAWD is the only household member

Definitions

ABAWD = Able Bodied Adult Without Dependent

-

- Age 18-54

-

- the month following the 18th birthday to the month of the 55th birthday

-

- No child under 18 in the SNAP household

- Not pregnant

- Not exempt on EMPLOY

-

- Evaluate and update SkillUP/EMPLOY codes at every application, mid-certification review, recertification and change report

- Participants who are homeless are exempt from SkillUp and are ABAWD exempt

- Codes have been added for veterans and participants that aged out of foster care. If a participant is a veteran or aged out of foster care between the ages of 18-24 in any state, they are not ABAWD

-

- Physically or mentally able to work

-

- If participant is not disabled, per SNAP definition, obtain a medical statement, unless the issue is obvious

- If the physical or mental issue is obvious, ensure the comment documents the situation

- Benefit Program Technician (BPT) discretion may be used. A worker does not need to see the person to make a determination.

- If an MRT decision is needed, use the FS-61 SNAP (Food Stamps) Summary to Determine Fitness for Work

- Only complete the FS-61 if unfitness for work is not obvious and needs to be determined through the Medical Review Team

- If participant is not disabled, per SNAP definition, obtain a medical statement, unless the issue is obvious

-

- Age 18-54

Three Month Limit for Non-Work Months

An ABAWD may only receive SNAP benefits for three months for the 36 month period beginning July 1 2023. All non-work months prior to that date are no longer counted. Each ABAWD has a clean slate and is able to receive three new non-work months.

Non-Work Months

Any month an ABAWD does not comply with work requirement and receives SNAP benefits, from any state, is a non-work month and counts toward the three month limit.

-

- Prorated months do not count toward the three month limit when determining initial eligibility

Work Requirement

Working or participating in and complying with the requirements of a qualified training program for 80 hours a month.

-

- When determining initial eligibility, a month is a calendar month

- When determining regained eligibility, a month is any consecutive 30 day period

Regaining Eligibility

ABAWDs who have lost eligibility for SNAP by receiving benefits for three non-work months can regain eligibility during the fixed 36 month period by meeting the 80 hour work requirement within a 30 consecutive day period.

Verification

See the FSD Policy Manual for verification policy and search ABAWD in IM Resources for recording requirements.

Do not use IMES to verify earned income or whether a person is meeting or has met ABAWD requirements.

Use Experian Verify to verify completion of the 80 hour work requirement only at application, if the applicant states they have regained eligibility through employment and if sufficient verification was not provided with the application.

ABAWD and FAMIS Examples

An ABAWD may only receive SNAP benefits for three non-work months from July 1, 2023 to June 30, 2026 (fixed 36 month period) unless the person meets the work requirement or is exempt from the work requirement:

-

- Anyone who is exempt from on EMPLOY is exempt from ABAWD. If coded exempt on EMPLOY, the WORKREQ screen will not appear in the flow

Any month an ABAWD does not meet the work requirement and receives SNAP benefits from any state is a non-work month and counts as one of the three months

-

- Prorated months do not count toward the three-month limit when determining initial ABAWD eligibility

Example

Nora applies on 07-28-23 and she is an ABAWD. She is not working or training.

Her Work Requirement Code is 01. The Begin Date is 07-28-2023, the date the work requirement code is effective.

Nora’s first non-work month is August 2023 since July is prorated and this is an initial determination.

Once an ABAWD who is not meeting the work requirement has received SNAP for three non-work months, the person loses eligibility.

Example

Cody is an ABAWD who has been receiving SNAP benefits and meeting the work requirement by working 80 hours. He is the only person in the household.

He is initially coded 03 – Work/Trng to Equal/Exceed 80 Hours; he has met the work requirement since he applied on 7/15.

WORKREQ shows the previously entered information.

On 8/31 Cody reports he lost his job and received his last paycheck on 8/28. Cody worked 20 hours a week until he lost his job and he is not eligible for unemployment, so he is not exempt from SkillUP, he remains an ABAWD.

-

- Fastpath to and review WORKREQ

- Update the Work Requirement Code field to 01, Cody is no longer meeting the work requirement

- Update the Begin Date field to the verified date that Cody’s employment status changed, 8/28

- Add Cody’s non-work months

-

- His first non-work month is September, the first month he will not meet the work requirement

- November is his last non-work month

-

FAMIS begins action to close his case in November, effective 11/30, unless Cody reports he is one of these:

-

-

- Meeting the work requirement

- Meeting a SkillUP exemption

- No longer identified as an ABAWD

-

ABAWDs who have lost eligibility by receiving SNAP for three non-work months can become eligible again during the fixed 36 month clock by:

-

- No longer being identified as an ABAWD because they’re:

- Meeting an exemption for SkillUP

- Disabled

- Pregnant

- Under age 18

- Over age 54 or

- There is now a child in the SNAP household

- Regaining eligibility as an ABAWD by meeting the 80-hour work requirement with a 30 consecutive day period

- No benefits, except expedite benefits, are issued until it is verified the ABAWD has met the work requirement

- No longer being identified as an ABAWD because they’re:

A participant must meet the 80 hour work requirement within a 30 consecutive day period, and this must be verified before they can be considered to have regained eligibility.

NOTE: IMES is not acceptable verification that an ABAWD is meeting or has met the work requirement.

Once an ABAWD regains eligibility the person remains eligible as long as he/she continues to meet the work requirement and all other eligibility factors.

Example

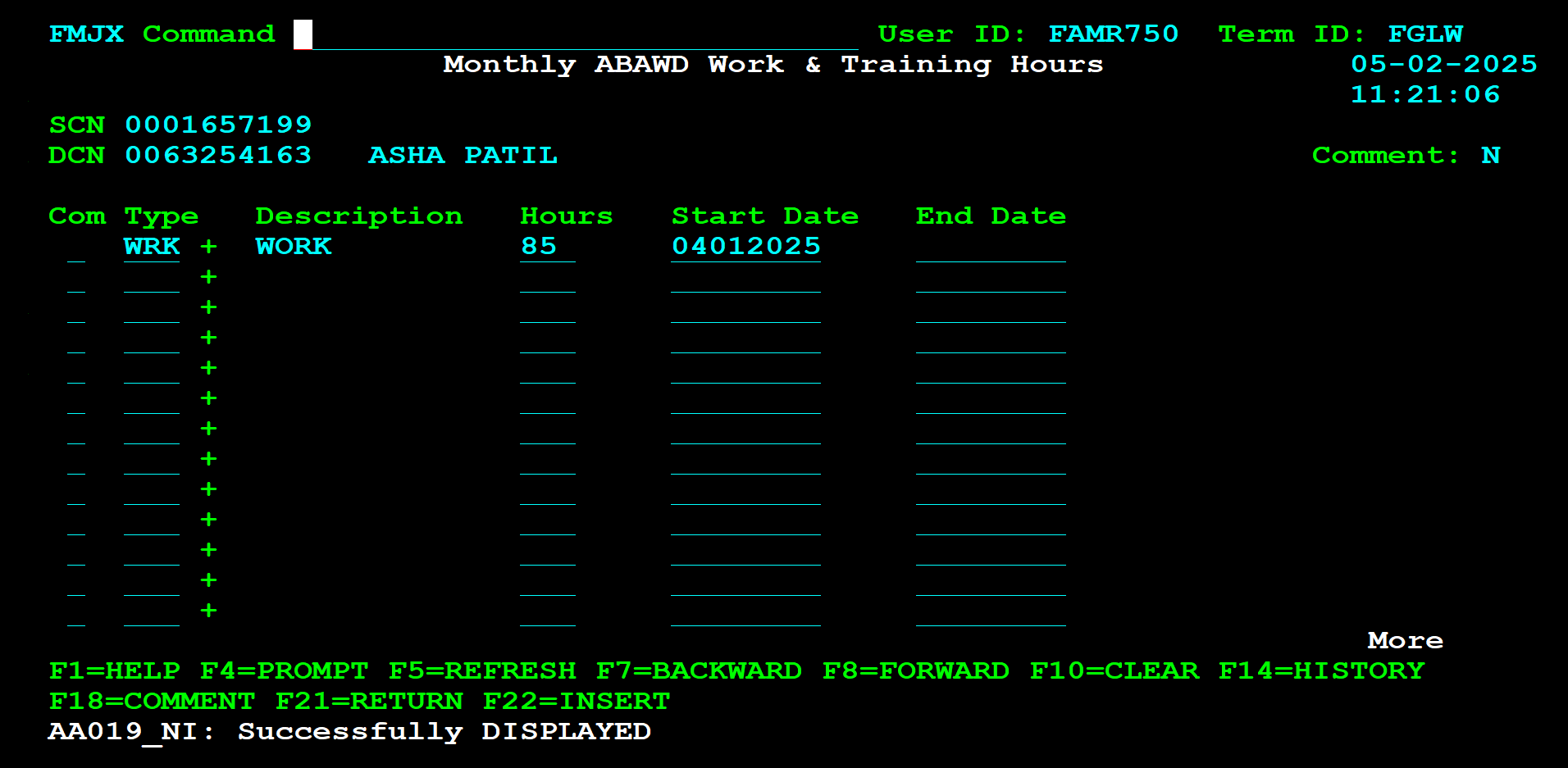

Asha applied on 07/01. Her first non-work month was July because her first month benefits were not pro-rated. She used three non-work months and her case closed 09/30.

She applies again 11/15 and provides checks stubs verifying she has been working at least 20 hours a week since 10/1. She has verified she met the work requirement, so she has regained eligibility as of 11/01.

Flowing to WORKREQ during the application interview, the Work Requirement Code and Begin Date fields show the last information entered.

Update the Work Requirement Code to 03- Work/Trng to Equal/Exceed 80 Hours and the Begin Date fields to record Asha is now working and meeting the work requirement.

Asha returned to work on 10/01, the date she regained eligibility is 11/01.

Update the ‘Have you or will you have worked or participated in a work program for 80 hours in a 30-day period?’ field to Y and enter the appropriate verification code. Do not delete the non-work months she has used.

Asha has regained eligibility. She may receive SNAP benefits as long as she continues to meet all eligibility factors, including the work requirement.

When a person has used their three non-work months, but reports they have, or will, regain eligibility by working 80 hours in a 30-day period, do not issue any benefits until verification of regained eligibility is provided, unless expedited. Verification can be postponed for expedite-eligible household.

Example

Armando used his three non-work months and his case closed several months ago. He reapplies on 12/05 and reports he started a new self-employment business 3 weeks ago and is working 25 hours per week.

He has not yet me the work requirement of 80 hours within 30 days. During the interview, the BPT determines Armando is expedite, but verification of Armando’s new income is not available.

Flowing to WORKREQ during the application interview, the Work Requirement Code and Begin Date fields show the last information entered.

Update the Work Requirement Code to 02 – 80 Hrs Not Met Yet and the Begin Date field to the application date.

An entry of Y is required in the ‘Have you or will you have worked or participated in a work program for 80 hours in a 30-day period?’ field when code 02 is used. A blank or CS in the VER field will pend the application for verification.

Armando is not able to upload verification that he will have met the work requirement. Since he is eligible for expedite benefits, the verification will be postponed and expedite benefits approved. Verification will be required before ongoing benefits can be approved.

When an ABAWD regains eligibility and stops meeting the work requirement again, they are allowed three additional consecutive non-work months once between July 1, 2023 and June 30, 2026.

The three additional months are consecutive. Once a person has received the first additional non-work month, the other two are considered used even if:

-

- Any of the three non-work months is prorated

- The ABAWD meets work requirement again in the second or third month

- The case closes before all three months are used

The first additional non-work month is the first month they are no longer complying with the work requirement and FAMIS populates the two remaining additional non-work months.

If the individual stops meeting the work requirement again, they are no longer eligible and will receive no further non-work months.

It is possible for an ABAWD to lose and regain eligibility multiple times during the 36-month period, but participants are limited to only one additional period of three non-work months. In order to receive benefits after exhausting both periods of non-work months, a participant must be either:

-

- In compliance with the work requirement or

- No longer be identified as an ABAWD

Example

Asha previously regained eligibility because she was working and meeting the work requirement. Asha reports she lost her job and her last day worked was 12/12, and she got her last check the same day. She did not meet the work requirement for December.

Fastpath to WORKREQ and update:

-

- Work Requirement Code to 01- Zero (0) Hours Worked\No Employment

- Begin Date field to the date she stopped meeting the work requirement

- When a participant is using the additional three non-work months, enter the first month the ABAWD stopped meeting the work requirement in the ‘Consecutive Months of Eligibility after Loss of Employment When Client Has Regained Eligibility’ field

- FAMIS automatically populates the next two months when CTRL is pressed since regained non-work months run consecutively

Even if Asha begins meeting the work requirement again in January, she will have exhausted her additional period of three non-work months.

Remember, additional non-work months can be prorated or partial month benefits.

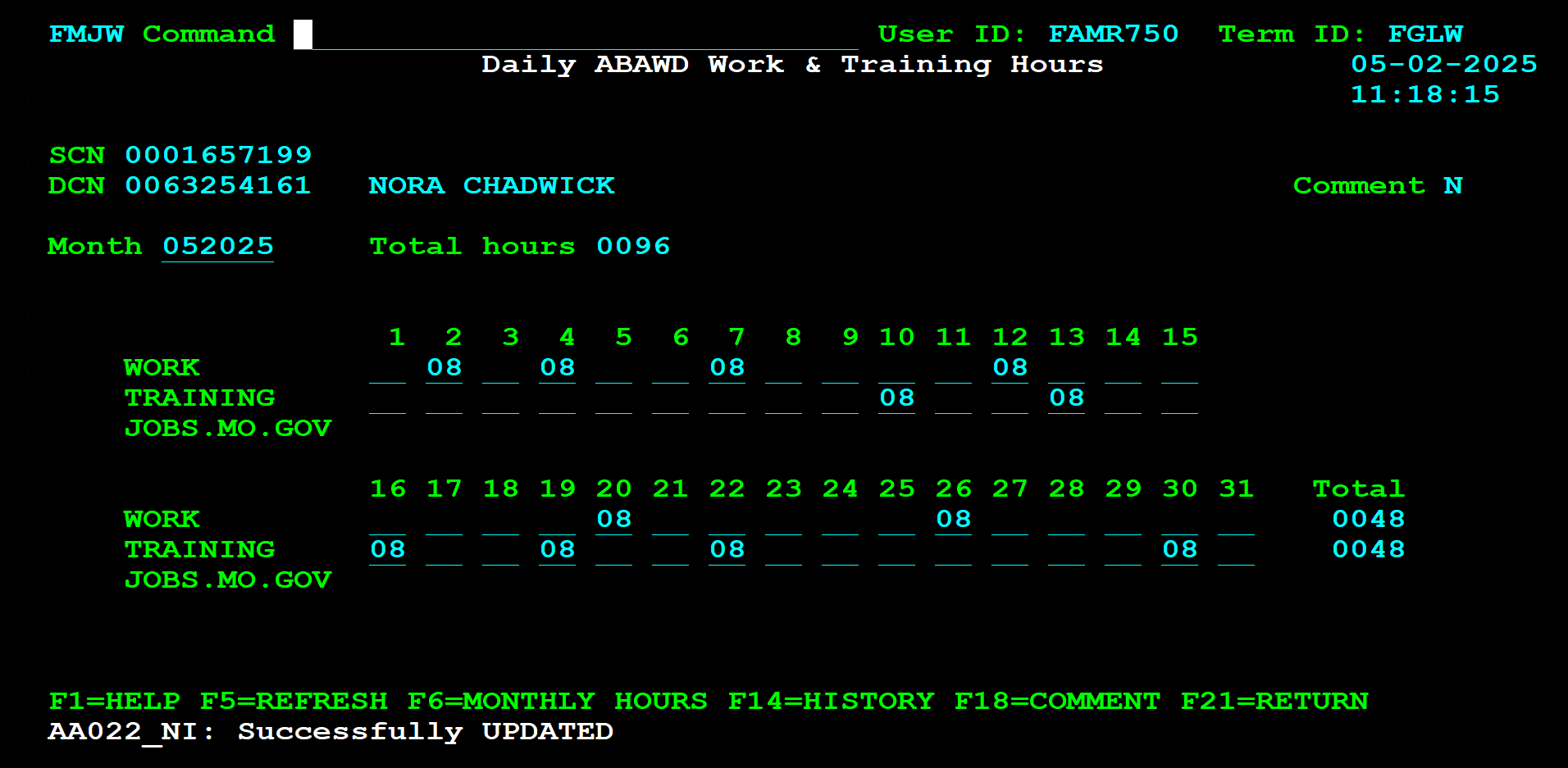

When an ABAWD’s working or training hours are verified, enter the verified hours on either the: Daily ABAWD Work & Training Hours (FMJW) or Monthly ABAWD Work & Training Hours (FMJX) and comment. Do not enter the same information on both screens, or it will count twice.

Daily ABAWD Work & Training Hours:

Use when the number of hours each day varies and cannot be projected.

Monthly ABAWD Work & Training Hours:

Monthly ABAWD Work & Training Hours:

Use when work or training hours are consistent and expected to continue for longer than one month

FMJW and FMJX cannot be accessed from the controlled flow. Access these screens by fastpathing to WORKREQ and pressing F6=DAILYHOURS during interviews, when completing mid-certification reviews and when making changes.

When a participant is coded 03 – Work/Trng to Equal/Exceed 80 Hours, once a week FAMIS reads the Daily ABAWD Work & Training Hours (FMJW) and Monthly ABAWD Work & Training Hours (FMJX) screens. If neither screen shows sufficient hours worked or trained FAMIS:

-

- Switches the person back to a Work Requirement code 01

- Tracks non-work months

- Closes the case/person when three non-months are used

When making entries on the Daily or Monthly screens, keep in mind:

-

- ABAWDs may use a mix of work and training to meet the 80 hour requirement

- Some ABAWDs may be self-employed or work odd jobs with schedules/hours which are difficult to project

- ABAWDs may turn in verification of hours worked during a month that is coded as a non-work month

- Enter all verification received

Delete previously entered non-work months when:

-

- Non-work months were entered in error

- When evaluating a previously rejected/excluded household member who did not actually receive benefits during the time frame the non-work months represent

- It is verified the participant worked/trained 80 hours in that calendar month.

If the non-work month was deleted because the work requirement was met, enter the hours on the Daily or Monthly Hours screens and make the appropriate comments.

Example

John Smith applies for SNAP benefits in July. During the application interview the BPT identifies him as an ABAWD and enters non-work months for August, September and October.

He did not return requested verification and the application was rejected.

Mr. Smith reapplies in November and WORKREQ still shows the previously entered non-work months.

The BPT:

-

- Reviews Payment History (PAYHIST/FM5F) and verifies he did not receive benefits for these months

- Deletes the non-work months

- Makes a comment explaining why on WORKREQ.